WHAT IS CCAP

The Child Care Assistance Program (CCAP) is a program funded by the Illinois Department of Human Services and assists low-income families with child care payments. There are 16 regional Child Care Resource & Referral agencies like ours across the sate. CCCC serves Christian, Logan, Macoupin, Mason, Menard, Montgomery, Morgan, Sangamon and Scott counties in central Illinois.

QUALIFICATIONS & ELIGIBILITY

Child care assistance is available to families who meet the following qualifications:

-

Live in Illinois

-

Have a child(ren) under the age of 13

-

Working and income eligible (see Income Guidelines below)

-

Attending school or a training activity such as ESL, high school, vocational training, or 2 or 4 year college program

-

Receive TANF and participate in an education training or other work activity

-

Are a teen parent (under age 20) in high school or GED program

-

Are searching for employment

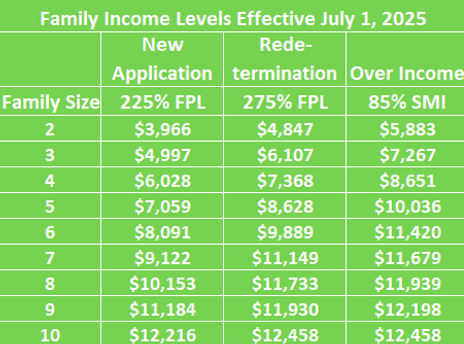

* A family is considered income eligible when the combined gross monthly income of all family / household members are at or below for the corresponding family / household size. ALL income must be combined to determine eligibility. Two parent families / households include those with 2 or more adults living in the home such as the applicant and their spouse or significant other with a child in the home.

Our CCAP Eligibility Specialists will determine your eligibility using pay stubs and other eligible income to calculate your total gross monthly income. You may use the Child Care Assistance Program Eligibility Calculator to estimate your monthly copayment, however, this calculator will only give an estimate. *Eligibility can only be determined by an Eligibility Specialist at the CCR&R.

Once your completed application is submitted, it will be reviewed based on the eligibility factors of the program, set by IDHS. Within 12 business days, you will receive an approval or denial notice, or request for additional information. If you do not receive a notification within 12 business days, please contact us.

If your application is approved, you are required to:

-

Pay a monthly copay to your provider based on income and family size

-

Complete paperwork to be re-determined at least every twelve months

-

Notify Community Child Care Connection of changes in job, income, childcare provider or family size

APPLYING FOR CHILDCARE ASSISTANCE

Think you may qualify? We make applying simple!

You can download the application for CCAP assistance below or request the form be mailed or emailed to you via our online request form here.

Be sure to click the download button in your browser to see and save the form!

Need help filling out your application?

This video can guide you!

Completed applications can be mailed to our office, faxed to (217) 525-2894, emailed to info@4childcare.org, or by using our 24 hour drop box located just outside our lobby door.